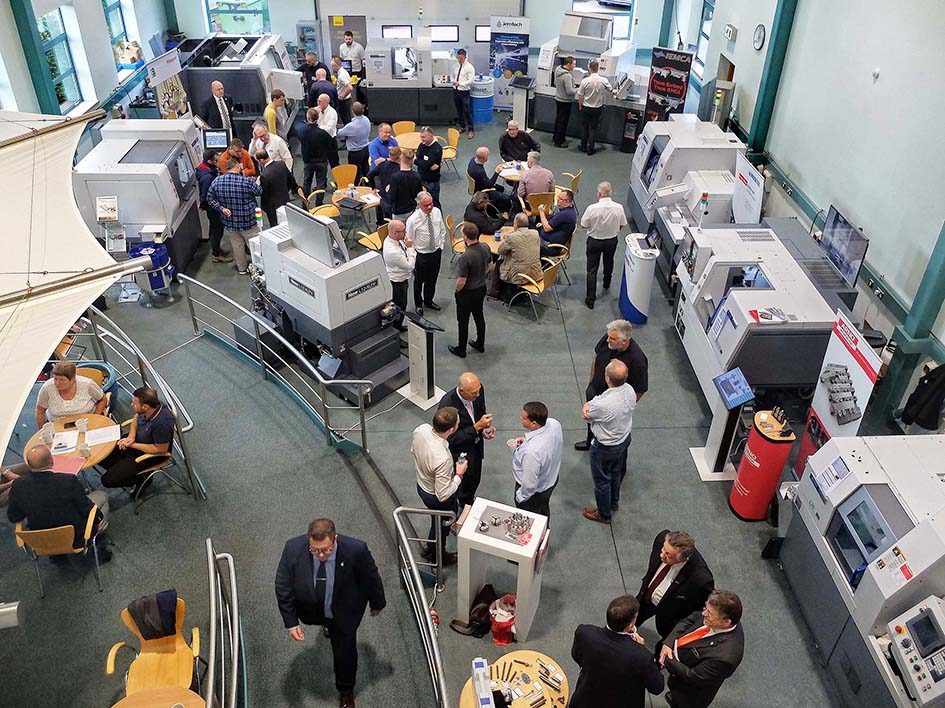

Citizen Machinery UK’s open house on 1st and 2nd October 2019 focused on machine price and purchasing options. This article highlights some of the points of discussion with potential customers regarding flexible machine finance.

The head of Citizen Finance, John Lane, who has experience in accountancy, banking and selling capital equipment, is evangelical on the subject of establishing a business case before purchasing new machinery and asking if the potential investment is financially viable. He observes that the subject of money is often one of the last items to be discussed when it should be one of the first.

Mr Lane says, “Financial aspects should be discussed right from the outset. As soon as the Citizen sales engineer or technical department confirms that a component can be made on a particular Cincom CNC sliding-head lathe or Miyano fixed-head turning centre, I recommend that the conversation about money starts.”

The key questions are: how much do you sell the components for; how many do you have to make; and how long will it take to make them on the proposed new machine? From this information it is possible to calculate quickly and easily whether the profit to be made in manufacturing the parts on the machine will justify the investment. Once the numbers show that the customer is predicted to make money, Citizen Finance can provide a wealth of options that may not be available in high street banks. Mr Lane says finance companies that understand the manufacturing industry are best placed to offer specific solutions. Banks have a vital role to play but cannot be masters of all financing; one size does not fit all.

Underpinning offers of finance is the statistic that, after providing a 100 per cent loan, Citizen Finance’s fund providers (selected banks, finance houses, etc), due to the high residual value of Cincom and Miyano lathes, carry a risk significantly lower than it would otherwise be. Even after five years, a typical Citizen lathe still has a sales value of almost two-thirds of its price when new. It has been known for a 10-year-old machine to sell for 45 per cent of its original value.

So what funding mechanisms are available for machine acquisition, bearing in mind that nine out of 10 lathes purchased from Citizen Machinery UK are financed? Mr Lane advises that there are four main options: hire purchase, finance lease, operating lease, and loan-and-charge.

Hire purchase means the user receives the capital allowance, makes fixed monthly payments normally over five years and owns the machine. A finance lease requires similar payments but machine ownership remains with the financier, the user obtaining tax relief on the rentals. An operating lease is essentially rental, can be over any period, may be matched to a contract and a longer agreement can offer lower monthly repayments than ownership. The machine is returned to Citizen or the financier at the end of the agreement, an option that is becoming increasingly popular. Loan-and-charge is rather like taking out a mortgage on the machine, which the customer owns from the first day.

Citizen Finance aims to keep customers’ cash flow under control. Its deposit-finding scheme underpins the order with no impact on the customer’s cash resources and secures the transaction. On delivery of the machine, customers enter a pre-arranged finance agreement and therefore have a revenue stream from the investment whilst paying for it.

A rule of thumb for budgeting over five years is a monthly payment of two per cent of the capital sum per month. The date of sale can be timed to optimise the customer’s VAT position or Citizen Finance can support a VAT deferral. The current enhanced first year tax allowance means the first £1 million of money invested is fully tax deductible, a limit that will reduce to £250,000 from January 2021. Citizen Finance considers the customer’s tax position to calculate the most tax-efficient funding solution.

Mr Lane advises, “Some customers prefer to pay a deposit using their own money to reduce the monthly repayments. However, the more cash invested before one starts to earn can reduce the return on a company’s capital. Similarly, increasing the instalments to reduce the loan term may not lead to a better fiscal outcome.

“We have options. A Citizen Finance package can be tailored to a customer’s needs and there is considerable flexibility. We need to talk to every customer to understand what they require. Then we try to match our offer to those needs, long- or short-term, on or off balance sheet.”

Emphasising how successful this approach is, Mr Lane points to manufacturing companies that buy one turning centre, particularly of the sliding-head variety, run it many hours per day, reducing labour costs and increasing profitability, then often invest quickly in a second, third and more machines. Some continue the process, resulting in a low level of attended production, increasing the profit ratio and levelling the playing field between British and Irish manufacturers and those operating in low-wage economies.

A major part of Citizen Finance’s role is discussing the return a customer seeks to achieve from an investment. Different methods of funding will yield various returns on investment and payback periods. The impact on a company and the potential results are evaluated to try to make sure the returns are what the shareholders, directors or proprietors want.

To make this happen, Citizen’s cost per part software shows whether an investment will make financial sense. The following aspects are calculated, indicating the exhaustiveness of the analyses: machine cost per month, total manufacturing cost per component, hourly and monthly margin, months until cash positive, and return on investment percentage.

If a machine is fitted with Citizen’s patented LFV (low frequency vibration) function, which has the effect of breaking stringy swarf into manageable chips when turning stainless steel, copper and plastics, lathe uptime can be increased dramatically. It is a result of not having to repeatedly stop the spindle to clear swarf that has become entangled around the tool or workpiece. In such cases, the enhanced financial benefits can easily be calculated.

One Citizen Machinery customer advised, “The move into sliding-head technology was a large investment for us. We knew we were turning away business or subbing work out that we could have done in-house. However, the prices we needed to quote to machine some components led us to think we might not make money, as our experience was in conventional CNC turning.

“When we analysed the sale price of the components against the Citizen cycle time studies, things began to get a lot clearer. Citizen’s business analysis helped us calculate our investment justification and we proceeded on the basis that this would yield us a good return. The reality met the expectation. Within a year we had a second machine and over the following years we bought eight in total.

“We felt it was important to review our business investments and in so doing, we found that the Citizen machines accounted for 40 per cent of our capital investment budget, 60 per cent of our turnover and 80 per cent of our profit!”