Europe’s marketing-leading photo-chemical etching firm secures investment from LDC for global growth drive

Mid-market private equity investor LDC has backed the £22.5m management buyout (MBO) of Precision Micro Limited, Europe’s market-leading photo-chemical etching company, from global aerospace, defence and energy group Meggitt PLC.

As part of the deal, LDC, the private equity arm of Lloyds Banking Group, has invested £13m of equity for a significant stake in the company, supporting a management team led by current Managing Director Ian McMurray.

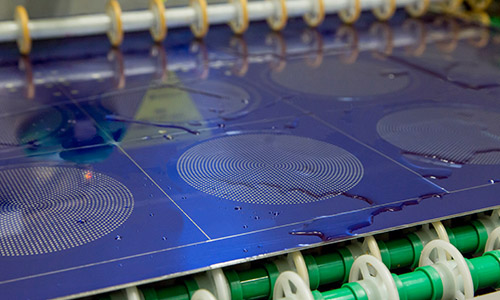

Operating from its state-of-the-art processing plant in Erdington, Birmingham, UK, Precision Micro manufactures more than 50 million high-precision metal components each year for major global manufacturing customers across multiple markets. Its pioneering photo-chemical etching process provides a cost-effective alternative to traditional sheet metalworking when machining precision parts from thin gauge metals.

Working to micron accuracy, its components enable next-generation aircraft engines, zero-emission vehicle technology, surgical instruments, titanium implants, a wide range of consumer electronics, safety-critical vehicle ABS braking systems and premium interior trim for brands including Rolls-Royce, Mercedes, Jaguar and Bentley.

With offices in Germany and The Netherlands, over 75% of its £15m sales come from overseas markets.

Ian McMurray, Managing Director of Precision Micro, said the investment would enable the company to take full advantage of several positive, global trends in its core markets, including the increasing preference for complex, burr and stress-free components manufactured from high-performance metals, rising quality standards, the miniaturisation of electronics and increasing demand for clean and fuel-efficient vehicles.

He said: “We see enormous opportunity across our markets as equipment manufacturers look for ever-more cost-effective, reliable, safe and high-performing components. Securing the backing of an experienced and supportive partner like LDC means we can invest further in the business, leveraging our unrivalled technical expertise and processing capabilities to further support our customers around the world with increasingly sophisticated requirements. This is an exciting time for our team as we invest in our future growth.”

Chris Handy, Investment Director at LDC, said: “Precision Micro’s reputation for technical excellence, service and innovation is world-class. Our investment is all about helping Ian and his team unlock the business’ potential by facilitating further investment in its processing capabilities, manufacturing capacity and new product introduction (NPI), helping it stay ahead of its market.”

Dave Johnson will join the business as Non-Executive Chairman. Mr Johnson has held several, senior positions at companies including Lucas, BTR and Dunlop Aerospace. Chris Handy will also join the board as Non-Executive Director.

With roots dating back to the early 1900s when it was founded as a division of engravers V Siviter Smith, Precision Micro was established in Birmingham in 1962 and was acquired by Meggitt in 2012.

Banking facilities were provided by HSBC.

LDC was advised by Gateley PLC, BDO and Springboard Corporate Finance.

Management was advised by Freeths and Cattaneo LLP.